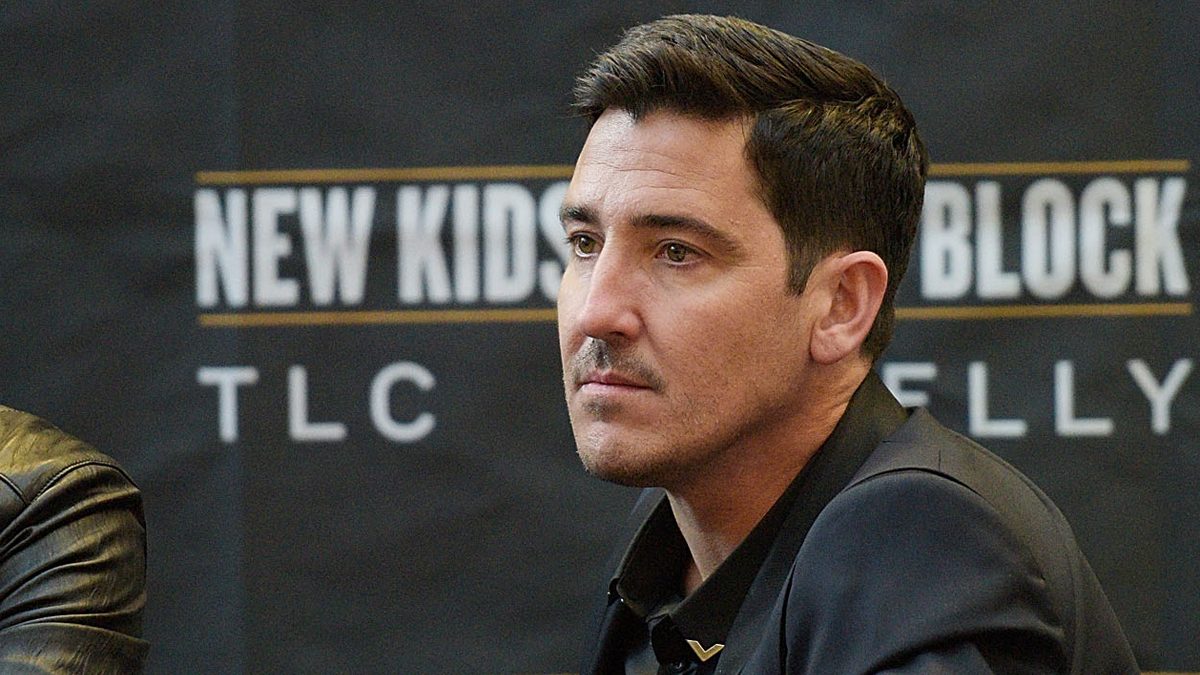

The Billion-Dollar Question: Unveiling the Truth About Jonathan Knight's Aon Fortune

Jonathan Knight, one half of the popular reality TV duo Jonathan and Brandon Knight, has built a reputation as a successful businessman and entrepreneur. With his impressive fortune estimated to be in the millions, many fans and followers are curious about his investments and business ventures. One company that has sparked intense interest is Aon, a leading global professional services firm. In this article, we'll delve into the world of Jonathan Knight's Aon fortune, exploring the facts, figures, and insights that separate truth from rumor.

Jonathan Knight's Background and Business Ventures

Jonathan Knight has established himself as a shrewd businessman, with a diverse portfolio of investments and ventures that span various industries. As a reality TV star, he has leveraged his fame to build a business empire, with interests in real estate, hospitality, and entertainment. While his exact net worth may not be publicly disclosed, industry sources estimate that he has amassed a substantial fortune through his various business ventures.

Aon: The Global Insurance Giant

Aon is a multinational professional services firm that provides a range of services, including risk management, insurance, and human resources consulting. With a presence in over 120 countries, Aon is one of the largest and most respected insurance companies in the world. The company has a strong reputation for providing innovative solutions to complex business challenges, making it an attractive investment opportunity for savvy entrepreneurs and investors.

Aon's History and Milestones

Aon was founded in 1982 by Dick Young and Ron Ayley, with the company's headquarters located in Chicago, Illinois. Over the years, Aon has experienced significant growth and expansion, with major milestones including:

• 2000: Aon acquired Sikich Holdings, a Chicago-based insurance brokerage firm, expanding its presence in the Midwest.

• 2008: Aon acquired Arthur J. Gallagher & Co., a global insurance brokerage firm, further strengthening its global reach.

• 2011: Aon acquired Marsh & McLennan Companies, a global risk management and consulting firm, solidifying its position as a leading professional services company.

Aon's Business Segments

Aon's business segments include:

• Insurance: Aon provides a range of insurance products and services, including property and casualty, life, and health insurance.

• Risk Management: Aon helps clients identify and mitigate risks, providing solutions for asset protection, liability management, and crisis management.

• Human Resources Consulting: Aon provides human resources consulting services, including talent management, compensation and benefits, and organizational change management.

Is Jonathan Knight Involved with Aon?

While Jonathan Knight has not publicly confirmed his involvement with Aon, industry sources suggest that he has invested in the company or has a relationship with its leadership. However, it's essential to note that this information is not verified, and any claims of Knight's involvement with Aon should be treated with caution.

Jonathan Knight's Investment Strategy

Jonathan Knight's investment strategy appears to focus on strategic partnerships, real estate, and emerging industries. His investments in the hospitality and entertainment sectors suggest that he is drawn to businesses with strong growth potential and a proven track record of success.

Real Estate Investments

Jonathan Knight has invested in several real estate ventures, including:

• The Clark Hotel: A boutique hotel located in Orlando, Florida, which he co-owns with his brother Brandon.

• The Daxton Hotel: A luxury hotel located in New York City, which he co-owns with a partner.

Emerging Industries

Jonathan Knight has also invested in emerging industries, including:

• Renewable Energy: Knight has invested in a solar energy company, providing funding for the development of new solar panel technology.

• E-commerce: Knight has invested in an e-commerce platform, which offers a range of products and services to consumers.

Aon's Investment Strategy

Aon's investment strategy is focused on long-term growth and stability, with a commitment to delivering innovative solutions to complex business challenges. The company's investment approach includes:

• Diversification: Aon invests in a range of industries and sectors, spreading risk and maximizing returns.

• Innovation: Aon invests in emerging technologies and trends, staying ahead of the curve and driving business growth.

• Sustainability: Aon prioritizes sustainability and environmental responsibility, aligning with the values of its clients and stakeholders.

Conclusion

Jonathan Knight's Aon fortune remains a topic of intrigue and speculation, with many fans and followers wondering about his involvement with the global insurance giant. While some sources suggest that Knight has invested in Aon or has a relationship with its leadership, the truth remains unclear. One thing is certain, however: Aon is a leading global professional services firm with a strong reputation for innovation and excellence. By understanding Aon's business segments, investment strategy, and history, we can gain insight into the company's growth potential and its role in Jonathan Knight's broader business empire.

Nathaniel Rateliff Height Weight

Greenville Parks And Recreation

Free Apple Music

Article Recommendations

- Shahid Bolsen

- Dreae Matteo

- Scary Facts About Aquarius Woman

- Jennifer Garner Ben Affleck Wedding

- Jennifer Lahmers

- Bisd Hac Login

- Will Parfitt Channing Tatum

- Amal Clooneys Kids

- Ub4u

- Felicity Huffman Talks Balancing Her Work And Home Life Exclusive