Unlocking Your Potential: The Ultimate Guide to FIQ Mastery

In today's fast-paced and competitive world, achieving Financial Independence, Quitting Work (FIQ), is not just a dream but a necessity for many. With the increasing burden of debt, rising living costs, and a growing desire for financial freedom, it's essential to understand the concept of FIQ and how to unlock your potential. This comprehensive guide will walk you through the key concepts, strategies, and mindset required to achieve FIQ and live the life you've always wanted.

FIQ is more than just a personal financial goal; it's a mindset shift that requires discipline, patience, and a clear understanding of your financial situation. By adopting a FIQ mindset, you'll be able to break free from the cycle of consumption and focus on creating wealth, freedom, and a fulfilling life. In this article, we'll delve into the world of FIQ, exploring the key concepts, strategies, and mindset required to achieve this coveted status.

Understanding the Benefits of FIQ

Achieving FIQ is not just about retiring early or achieving financial independence; it's about living a life that truly aligns with your values, passions, and goals. By FIQing, you'll be able to:

- Live a life of purpose and fulfillment

- Pursue your passions and interests without financial constraints

- Create wealth and legacy for yourself and your loved ones

- Break free from the 9-to-5 grind and live life on your own terms

- Enjoy more free time, travel, and experiences

- Pursue your own entrepreneurial ventures and side hustles

- Invest in yourself and your personal development

The Psychology of FIQ

FIQ is not just about numbers and financial metrics; it's also about the psychological aspect of achieving financial independence. By understanding your own motivations, desires, and fears, you'll be able to overcome the mental barriers that hold you back from achieving FIQ. Some common psychological barriers to FIQ include:

- Fear of uncertainty and change

- Fear of loss of identity and purpose

- Fear of not being able to provide for loved ones

- Fear of not being able to pursue passions and interests

- Fear of being too young or too old to achieve FIQ

Setting Your FIQ Goals

To achieve FIQ, you need to set clear and achievable goals. This involves understanding your financial situation, values, and priorities. Here are some steps to help you set your FIQ goals:

- Identify your financial goals: What do you want to achieve in terms of saving, investing, and debt repayment?

- Assess your current financial situation: What's your income, expenses, assets, and liabilities?

- Determine your values and priorities: What's most important to you in life, and how does that align with your financial goals?

- Create a budget and financial plan: How will you achieve your financial goals, and what steps will you take to get there?

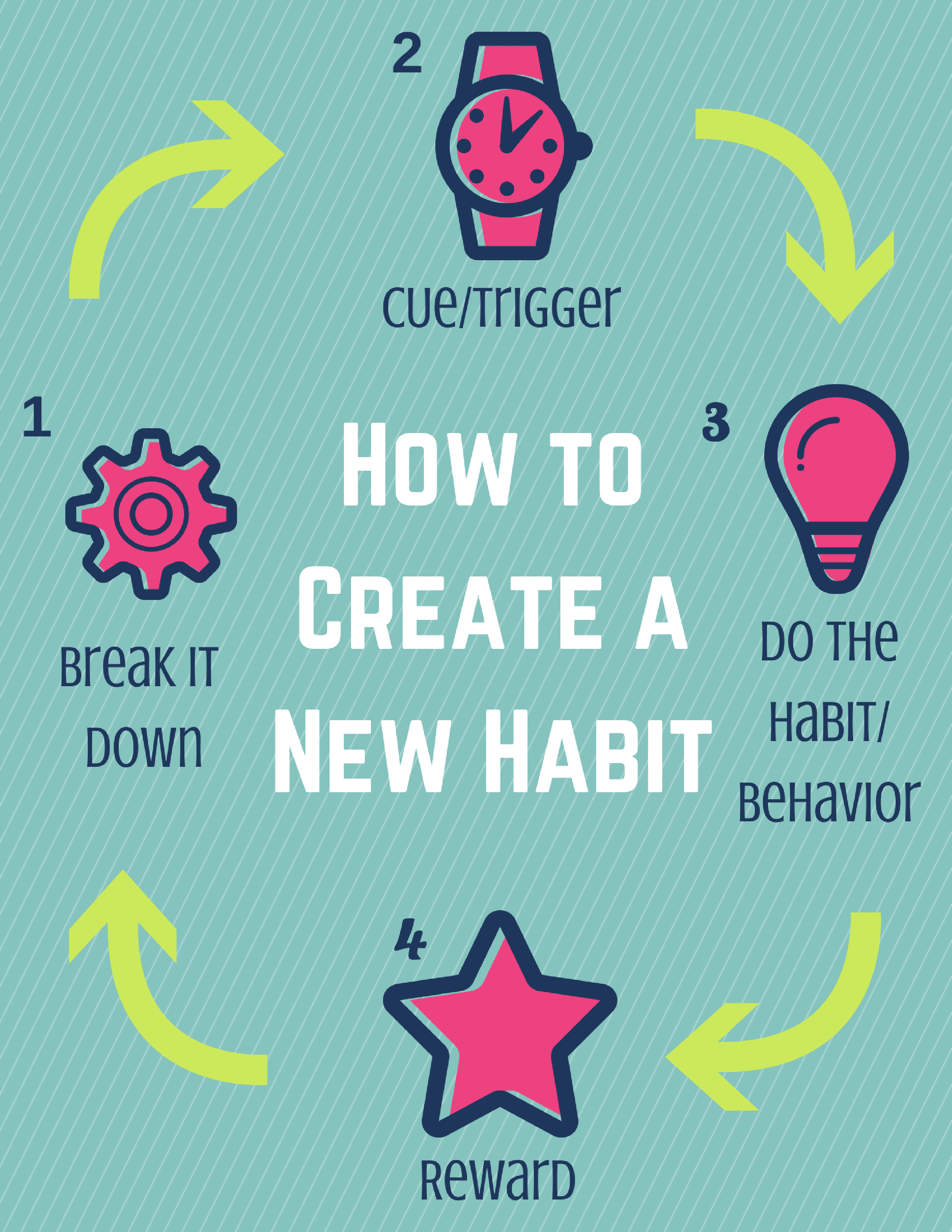

- Break down big goals into smaller, manageable steps: How will you overcome obstacles and stay motivated on your journey to FIQ?

Building an Emergency Fund

One of the most critical components of achieving FIQ is building an emergency fund. This fund will provide you with a financial safety net, allowing you to weather financial storms and avoid going into debt. Here are some tips to help you build an emergency fund:

- Calculate your emergency fund needs: How much do you need to cover 3-6 months of living expenses?

- Start small: Begin with a manageable amount, and gradually increase it over time

- Prioritize saving: Make saving for your emergency fund a priority, and avoid dipping into it for non-essential expenses

- Consider other sources of emergency funding: Can you use other assets, such as retirement accounts or life insurance, to supplement your emergency fund?

- Automate your savings: Set up automatic transfers from your checking account to your emergency fund account

Investing for FIQ

Investing is a critical component of achieving FIQ. By investing your money wisely, you'll be able to grow your wealth, achieve financial independence, and create a sustainable income stream. Here are some tips to help you invest for FIQ:

- Understand your investment options: What types of investments are right for you, and how will you allocate your assets?

- Consider low-cost index funds: These funds offer broad diversification, low fees, and potential for long-term growth

- Invest in a tax-efficient manner: Consider tax-loss harvesting, charitable donations, and other strategies to minimize taxes

- Diversify your portfolio: Spread your investments across different asset classes, sectors, and geographic regions

- Consider alternative investments: Real estate, cryptocurrencies, and other alternative investments can offer diversification and potential for growth

Mindset and Discipline

Achieving FIQ requires a mindset shift and discipline. Here are some tips to help you stay on track:

- Cultivate a long-term perspective: Focus on the big picture, and avoid getting caught up in short-term market fluctuations

- Develop a growth mindset: Be open to learning, adapting, and taking calculated risks

- Prioritize saving and investing: Make saving and investing a priority, and avoid dipping into your emergency fund for non-essential expenses

- Stay disciplined and patient: Avoid getting caught up in get-rich-quick schemes, and stay focused on your long-term goals

- Continuously educate yourself: Stay up-to-date on personal finance, investing, and entrepreneurship, and attend workshops, webinars, and conferences to improve your skills

Overcoming Obstacles

Achieving FIQ is not without its challenges. Here are some common obstacles, and tips to help you overcome them:

- Fear of uncertainty and change

- Fear of not being able to provide for loved ones

- Fear of not being able to pursue passions and interests

- Fear of being too young or too old to achieve FIQ

- Fear

Alina Habba Husband

Danielunjata Married

Blowout R With Curly Hair

Article Recommendations

- Nicole Briscoe

- Bernard Ormale

- Now Gg

- Dave Blunts Weight

- Otto Kilcher

- Who Isanaa Lathans Husband

- Russell Crowe Terri Irwin

- Anne Grace Morgenstern

- Hub4u Tv

- Dakoassman