Streamlining Your Connecticut Payroll with OpenPayroll CT

As a business owner in Connecticut, managing payroll can be a complex and time-consuming task. With multiple state and federal regulations to navigate, it's easy to get bogged down in paperwork and administrative tasks. However, with the right solution, you can simplify your payroll process and free up more time to focus on growing your business. OpenPayroll CT is a leading payroll software designed specifically for businesses in Connecticut, offering a range of features and benefits that can help you streamline your payroll and improve your bottom line.

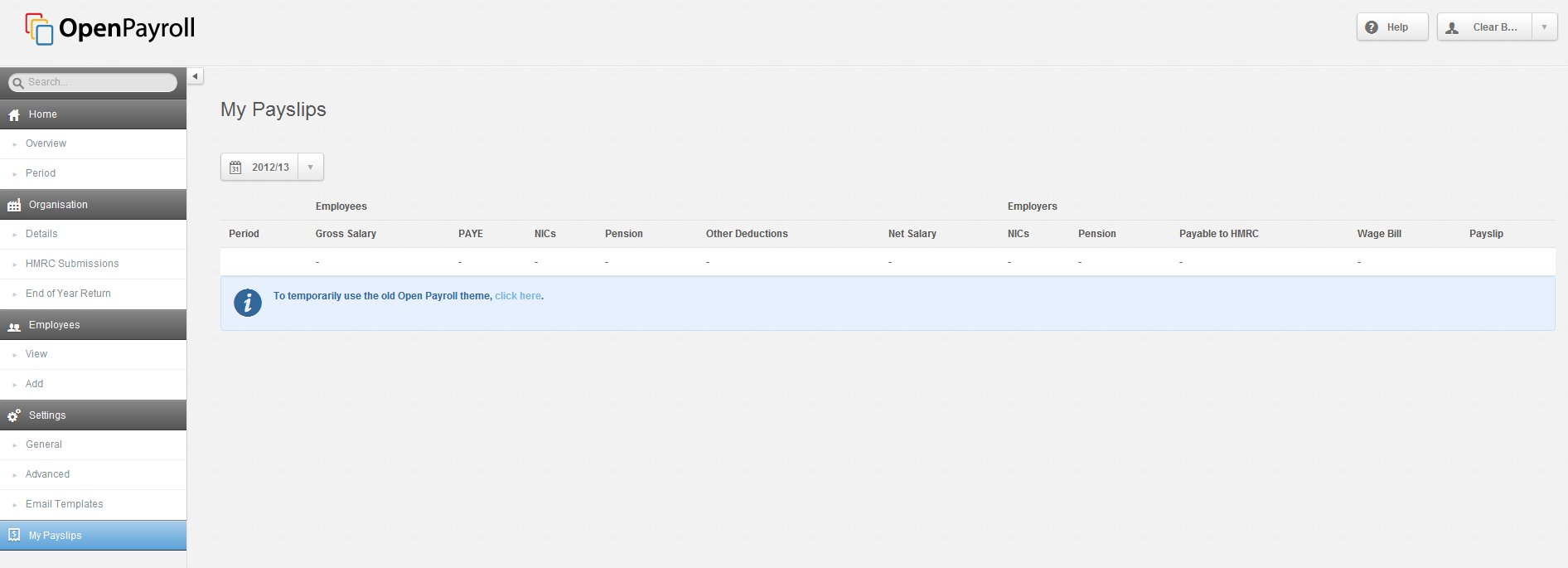

Whether you're a small business owner or a large enterprise, OpenPayroll CT is an ideal solution for anyone looking to simplify their payroll process. With its user-friendly interface and comprehensive features, you can easily manage your payroll, from paycheck processing to tax compliance. But what sets OpenPayroll CT apart from other payroll software options? In this article, we'll explore the benefits of using OpenPayroll CT and show you how it can help you streamline your Connecticut payroll.

Understanding the Importance of Payroll Compliance

As a business owner in Connecticut, it's essential to understand the importance of payroll compliance. The Connecticut Department of Labor and the Internal Revenue Service (IRS) have strict regulations governing payroll, and failure to comply can result in fines, penalties, and even legal action. With OpenPayroll CT, you can rest assured that your payroll is compliant with all relevant regulations, including state and federal tax laws.

In addition to compliance, payroll also plays a critical role in employee satisfaction and retention. When employees receive timely and accurate paychecks, they're more likely to be engaged and committed to their work. This, in turn, can lead to improved productivity and reduced turnover. By using OpenPayroll CT, you can ensure that your employees receive the pay they deserve, on time and in compliance with all relevant regulations.

Key Features of OpenPayroll CT

So, what sets OpenPayroll CT apart from other payroll software options? Here are just a few of the key features that make it an ideal solution for businesses in Connecticut:

- Simplified Payroll Processing: OpenPayroll CT allows you to easily process payroll, from calculating salaries and benefits to preparing paychecks and filing tax returns.

- Comprehensive Tax Compliance: With OpenPayroll CT, you can ensure that your payroll is compliant with all relevant tax regulations, including state and federal taxes.

- Employee Management Tools: OpenPayroll CT offers a range of employee management tools, including HR management, time and attendance tracking, and benefits administration.

- Customizable Reports and Analytics: With OpenPayroll CT, you can generate customized reports and analytics to help you make data-driven decisions about your business.

- Secure and Scalable: OpenPayroll CT is a secure and scalable solution, designed to meet the needs of businesses of all sizes.

Benefits of Using OpenPayroll CT

So, what are the benefits of using OpenPayroll CT? Here are just a few of the advantages you can expect:

- Improved Productivity: By streamlining your payroll process, you can free up more time to focus on growing your business.

- Reduced Errors and Mistakes: With OpenPayroll CT, you can reduce errors and mistakes in your payroll process, ensuring that employees receive accurate paychecks.

- Increased Compliance Confidence: By ensuring that your payroll is compliant with all relevant regulations, you can reduce the risk of fines, penalties, and legal action.

- Enhanced Employee Experience: By providing timely and accurate paychecks, you can improve employee satisfaction and retention.

- Cost Savings: By automating your payroll process, you can reduce costs associated with manual processing and administrative tasks.

Implementation and Integration

Implementing OpenPayroll CT is a straightforward process that can be completed quickly and easily. Here's what you need to know:

- Getting Started: To get started with OpenPayroll CT, simply sign up for a demo account and explore the software's features and benefits.

- Configuring Your Payroll Process: Once you've signed up, you can configure your payroll process, including setting up pay frequencies, tax deductions, and benefits.

- Integrating with Existing Systems: OpenPayroll CT can be integrated with existing HR systems, accounting software, and other payroll solutions.

- Training and Support: OpenPayroll CT offers comprehensive training and support to ensure that you get the most out of the software.

Frequently Asked Questions

Here are some frequently asked questions about OpenPayroll CT:

- Q: Is OpenPayroll CT user-friendly?

A: Yes, OpenPayroll CT is designed to be user-friendly, with an intuitive interface and comprehensive tutorials. - Q: How much does OpenPayroll CT cost?

A: The cost of OpenPayroll CT varies depending on the plan you choose, but is competitive with other payroll software options. - Q: Can I integrate OpenPayroll CT with my existing systems?

A: Yes, OpenPayroll CT can be integrated with existing HR systems, accounting software, and other payroll solutions. - Q: What kind of support does OpenPayroll CT offer?

A: OpenPayroll CT offers comprehensive training and support, including online resources, phone and email support, and in-person training.

Conclusion

In conclusion, OpenPayroll CT is a leading payroll software designed specifically for businesses in Connecticut. With its user-friendly interface and comprehensive features, you can simplify your payroll process, reduce errors and mistakes, and improve compliance confidence. Whether you're a small business owner or a large enterprise, OpenPayroll CT is an ideal solution for anyone looking to streamline their payroll and improve their bottom line. By implementing OpenPayroll CT, you can ensure that your payroll is compliant with all relevant regulations, and that your employees receive the pay they deserve, on time and in compliance with all

Zoe Chip

Travis Fimmel

Laura Ingraham Husband

Article Recommendations

- Sean Preston Federline 2024

- Diana Jean Lovejoy Heart Attack

- Erman Wife

- Funnyark Jokes

- Clement Hyundai

- Xposed Magazine

- Can Yaman Wife

- Sweet Mandy Bs Bakery

- Greys Anatomyrloan

- The Last Alaskans