Mastering the Art of Tax Compliance: Your Comprehensive Guide to Seminole County Tax Collector

Are you tired of feeling overwhelmed by the complexities of tax compliance? Do you struggle to navigate the intricate world of property taxes, sales taxes, and other tax obligations? Look no further! As a resident of Seminole County, Florida, you're fortunate to have access to the Seminole County Tax Collector's office, dedicated to providing expert guidance and support throughout the tax year. In this comprehensive guide, we'll walk you through the ins and outs of tax compliance, ensuring you're equipped to tackle even the most daunting tax-related tasks with ease.

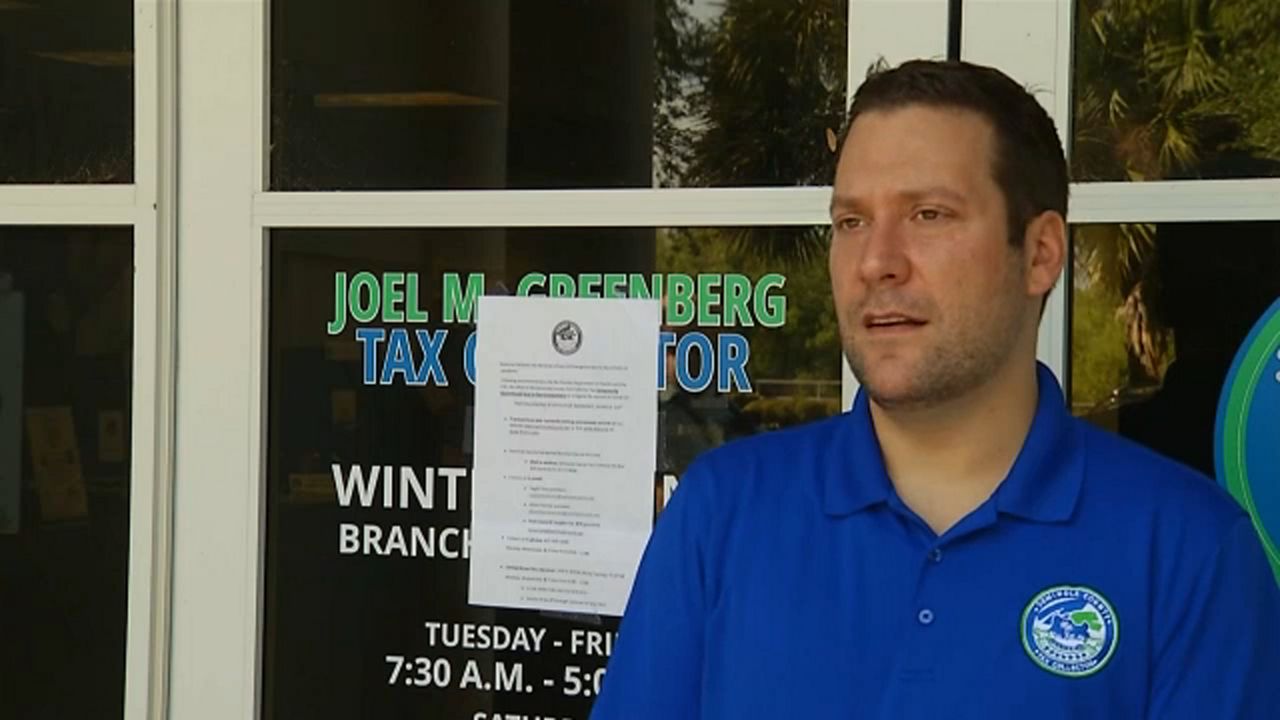

Seminole County Tax Collector: Your Gateway to Tax Efficiency

The Seminole County Tax Collector's office is the first point of contact for taxpayers seeking assistance with property tax-related matters. As the chief tax administrator for Seminole County, the Tax Collector is responsible for collecting and administering property taxes, as well as providing valuable resources and support to the community. With a staff of experienced professionals and a range of services offered, the Seminole County Tax Collector's office is the perfect place to turn when seeking guidance on tax compliance.

Understanding Your Tax Obligations

As a property owner in Seminole County, you're required to pay property taxes on your real estate, including assessments for local schools, fire departments, and other public services. These taxes are typically assessed annually and are used to fund essential public services and infrastructure. In addition to property taxes, you may also be subject to sales taxes on certain goods and services purchased in Seminole County.

To ensure you're meeting your tax obligations, it's essential to stay informed about the tax laws and regulations that govern property and sales taxes in Seminole County. The Seminole County Tax Collector's office provides regular updates and reminders on tax payment deadlines, payment methods, and any changes to tax rates or regulations.

Tax Payment Options

The Seminole County Tax Collector's office offers a range of payment options to suit your needs, including:

• Online payment: Make secure payments via the Seminole County Tax Collector's website or mobile app

• Mail: Send payments via certified mail or cashier's check to the address listed on your tax bill

• In-person: Visit the Seminole County Tax Collector's office to make payments in person

• Phone: Call the Tax Collector's office to make payments over the phone

Preparing for Tax Season

As tax season approaches, it's essential to get a head start on your tax obligations. Here are some tips to help you prepare:

• Gather necessary documents: Collect all relevant tax-related documents, including your property tax bill, property deed, and any other relevant paperwork

• Review your tax bill: Carefully review your tax bill to ensure all information is accurate and complete

• Make a payment plan: If you're unable to pay your taxes in full, consider setting up a payment plan with the Seminole County Tax Collector's office

• Take advantage of tax credits: Claim any available tax credits, such as the homestead exemption, to reduce your tax liability

Important Tax Deadlines

Don't miss these critical tax deadlines in Seminole County:

• Payment due date: Typically due on July 3rd, with a 10% penalty applied if payments are not received by this date

• Abatement deadline: Apply for a payment abatement by July 15th to avoid additional penalties

• Annual report: Submit your annual report to the Seminole County Tax Collector's office by October 15th

Additional Resources

In addition to the Seminole County Tax Collector's office, there are several other resources available to help you navigate the world of tax compliance:

• Seminole County Tax Collector's website: Visit the official website for up-to-date information on tax rates, payment deadlines, and other tax-related news

• Taxpayer Education Series: Attend one of the Seminole County Tax Collector's office-sponsored taxpayer education seminars to learn more about tax compliance and other topics

• Property appraiser: Contact the Seminole County Property Appraiser's office for information on property values and assessments

Frequently Asked Questions

Got questions about tax compliance in Seminole County? Here are some frequently asked questions and their answers:

Q: What is the process for appealing my tax bill?

A: Contact the Seminole County Tax Collector's office to discuss your options and file an appeal

Q: Can I get a payment plan if I'm unable to pay my taxes in full?

A: Yes, the Seminole County Tax Collector's office offers payment plans for taxpayers who are unable to pay their taxes in full

Q: How do I know if I'm eligible for a homestead exemption?

A: Contact the Seminole County Property Appraiser's office to determine if you're eligible for the homestead exemption

Conclusion

Navigating the complex world of tax compliance can be overwhelming, but with the right resources and support, you can achieve tax efficiency and peace of mind. The Seminole County Tax Collector's office is dedicated to providing expert guidance and support to taxpayers, ensuring you're equipped to tackle even the most daunting tax-related tasks. By staying informed, preparing ahead of time, and taking advantage of available resources, you can master the art of tax compliance and enjoy a stress-free tax season.

Choi Jin Hyuk

Lil Jeff

Chastity Bono

Article Recommendations

- Michael Boulos Net Worth

- Justin Trudeau Networth

- Toongod

- Davido Fortune 2024

- When Is Jacqueline Mcguinness Wood Babyue 2024

- Manuela Escobar

- G Eazy And Halsey Back Together

- Names Of Theevenwarfs

- Faceit Analyser

- Joanna Lumley Age 20